April 7th, 2021

First of all, sorry for missing last month’s report! To be brutally honest, I procrastinated it because February was the first month we didn’t grow at least 15% month over month since last June! Traffic only grew 2%, and other metrics like revenue were down, unfortunately.

I’ve had some time to sit with that and reminded myself this: things are not always going to grow massively month over month.

It’s important to look at the bigger picture. If we zoom out and look at year-over-year growth, February was up +525% in traffic, and revenue up +220%.

A less than expected month should never stop me from sharing, though. And I give you the promise that I won’t miss another month this year.

Now that’s out of the way, let’s talk about March 2021:

- Revenue: $21,951 (-5% MoM)

- Uniques (GA): 592K (+14% MoM)

- Visitors (SA): 898K (+3% MoM)

- Pageviews (SA): 1.3M (+8% MoM)

- Newsletter: 69.5K Total (+9.9K) (+18% MoM)

Traffic

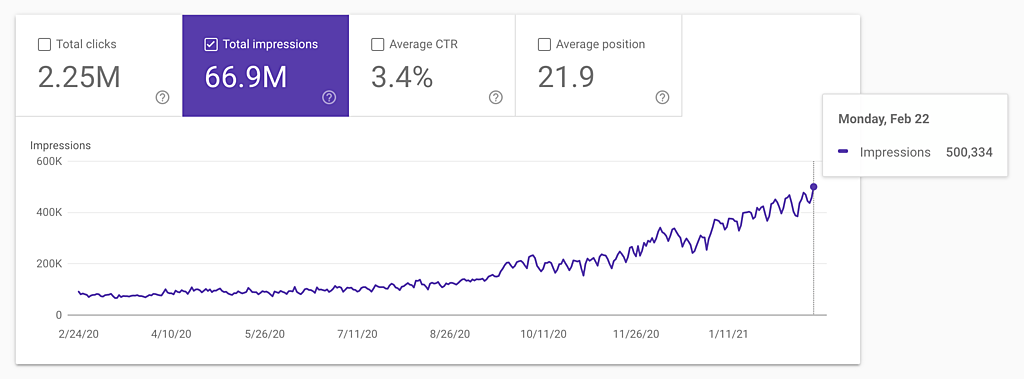

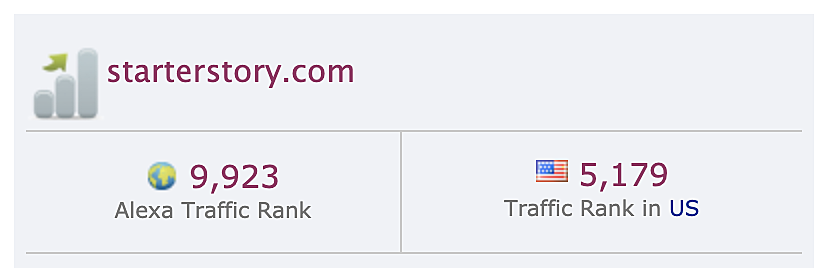

March 2021 is the biggest month we’ve ever had in traffic, although our month-over-month growth is not as impressive as it has been in the last 8 months.

I wish I could give a great answer as to why we didn't grow 15%+, but the truth is I’m not exactly sure.

Over the past few months, we captured an amazing opportunity with our Lean SEO strategy, but to continue to grow, we’ll need to keep making changes and adjustments to that strategy.

In other words, we learned what it takes to go from 100K -> 1M per month, now we’ll learn what it takes to go from 1M -> 10M per month. I don’t have the answers to that right now. All we can do is focus and learn and experiment. Our goal is still to hit 5M by the end of the year.

Revenue

On the monetization side, revenue and new paid memberships has been slowing.

I think this is a bit natural as January and the preceding months were so big for us, plus we had a lot of attention from Lean SEO.

More people are presumably starting a business in January than they are in February and March, and maybe that is just part of the natural cycle?

One of my goals this month is to look closer at conversions and understand this a bit more. More to come next month.

Newsletter

Our newsletter is getting very big now (70K) and we’ve brought someone on part-time to focus on it.

David Bustos, from Spain (who’s been with us from the beginning), will now lead up the weekly newsletter and give it the focus and attention it deserves.

At the current pace, our newsletter would grow 10k per month. So by the end of the year, we’ll effectively be at 150K (and that’s if we didn’t grow at all).

It’s important that we spend a lot of time delivering a super high-quality newsletter with a lot of value. I couldn't do that on my own anymore!

Growth Ideas Database

Over the past month, Sam has been working on launching the Starter Story Growth Database - a collection of 200+ proven ways to grow your business.

The goal for this is two-fold (1) to have another staple for our premium membership and (2) to add 200+ pieces of content to the blog.

Eventually, this database will grow to 1,000+ ways to grow your business, and further, 1,000+ pieces of content around marketing.

We are running launch tests on it right now - we’ll officially launch this in the next couple weeks.

Business Idea Profiles

In addition to our database of almost 4,000 business ideas, we are launching individualized pages for business ideas.

Want to start a subscription box business? We put all of the data here for you, including startup costs, case studies, pros and cons, ways to grow, etc.

We are doing a lot behind the scenes to fill out these pages. Over time, we’ll continue to add more data and “sub-pages” for each business idea.

It’s very early days for this feature, but below is a look at daily traffic over the last 3 months to these pages, it’s growing!

Scaling Our Freelancer Efforts

One of the tenets of Starter Story is our focus on software. On paper, we are a media company, but at our core, we are a software company - with a laser focus on data, process, and automation.

By leaning on data and software, we can stay lean as a team (and keep costs low). Right now, we are just about 5 team members working full-time.

But behind the scenes, there are dozens of people working on Starter Story, whether it’s freelancers or even our users helping us generate content.

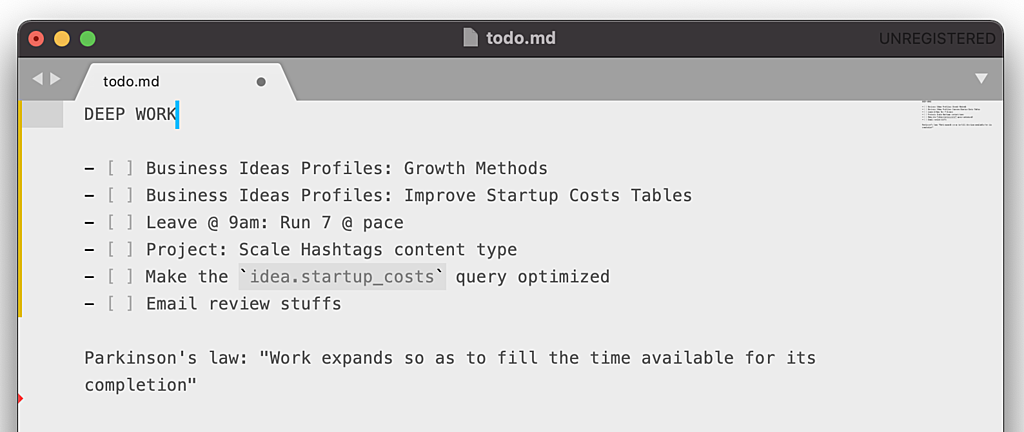

I’ve been building a new backend/system that these freelancers use to get work done.

It allows us to assign work to freelancers, and review their work quickly. Additionally, we can track the amount of time that tasks take, as well as costs to complete projects.

It’s still very early days, but this is the future of scaling our content efforts. The possibilities here blow my mind. More to come next month.

The Business Wikipedia

We are heads down working on a public-facing “wiki” on Starter Story.

What’s a wiki? A wiki is a database/content that anyone can edit.

We’re going to build the Wikipedia for entrepreneurs / the Wikipedia for businesses. This has always been the plan for Starter Story long-term, and now we’re finally getting started...

More on this next month.

Thanks for reading!

Thanks for reading!